Content

A strong form finance lease is one that has a transfer of ownership, a bargain purchase option , or a purchase option the lessee is reasonably certain to exercise. With a strong form lease, the asset is depreciated over the useful life of the asset as it is assumed the lessee will own the asset at the end of the lease term. For weak form finance leases where the lessor retains ownership of the asset at the end of the lease term, the asset is depreciated over the shorter of the useful life or the lease term. Using the facts and circumstances presented, we can use LeaseQuery’s present value calculator to calculate the present value of the lease payments.

- Some systems permit the full deduction of the cost, at least in part, in the year the assets are acquired.

- Changing the value of «factor» can be accomplished using our Declining Balance Method Depreciation Calculator.

- In the first year, the book value of the truck is the same as the truck’s original purchase price because the truck hasn’t been depreciated yet.

- So, we’ll complete an example here—complete with full ten-year depreciation.

- The double-declining balance method is one of the depreciation methods used in entities nowadays.

Because the book value declines as the asset ages and the rate stays constant, the depreciation charge falls each year. Download thisaccounting examplein excel to help calculate your own Double Declining Depreciation problems. Which translates to depreciation of $400 per year for the company’s van.

When Is The Double Declining Method Used?

Straight-line rate of 10%), the depreciation rate of 20% would be charged on its carrying value. For a comprehensive course on fundamental accounting concepts , sign up for the Introductory Financial Accounting course from Udemy.

It also matches revenues to expenses in that assets usually perform more poorly over time, so more expenses are recognized when the performance and income is higher. First, the IRS does not permit the use of double declining balance depreciation for tax purposes, but it does allow MACRS, which is similar to DDB. 1- You can’t use double declining depreciation the full length of an asset’s useful life. Since it always charges a percentage on the base value, there will always be leftovers. Enter the straight line depreciation rate in the double declining depreciation formula, along with the book value for this year.

Depreciation Expense: Straight

Residual value is considered only in the last year of the asset’s life. This is when that year’s depreciation is limited to the amount that will reduce the asset’s book value to its residual value. Secondly, you could switch to straight line method at this point. In order to do that, we need to figure out what deprecation amount we should take from the last four years of the truck’s useful life. We can calculate that by subtracting the salvage value ($5,000) from the book value at the end of year six ($12,464.27). The form of journal entry and balance sheet account presentation are just like the straight-line illustration, but with the revised amounts from this table. Subtract salvage value from book value to determine the asset’s total depreciable amount.

Straight Line Basis Definition – Investopedia

Straight Line Basis Definition.

Posted: Sat, 25 Mar 2017 16:20:40 GMT [source]

Note that the double-declining multiplier yields a depreciation expense for only four years. Also, note that the expense in the fourth year is limited to the amount needed to reduce the book value to the $20,000 salvage value. In the second year, depreciation is calculated in a regular way by multiplying the remaining book value of $36,000 ($40,000 — $4,000) by 40%.

Prepare a double declining balance depreciation schedule, switching to straight line at the most opportune time. To calculate the depreciation expense for the first year, we need to apply the rate of depreciation (50%) to the cost of the asset ($2000) and multiply the answer with the time factor (3/12). Since double-declining-balance depreciation does not always depreciate an asset fully by its end of life, some methods also compute a straight-line depreciation each year, and apply the greater of the two. This has the effect of converting from declining-balance depreciation to straight-line depreciation at a midpoint in the asset’s life. The double-declining-balance method is also a better representation of how vehicles depreciate and can more accurately match cost with benefit from asset use. The company in the future may want to allocate as little depreciation expenses as possible to help with additional expenses. Depreciation expense is the recognition of the reduction of value of an asset over its useful life.

Understanding Ddb Depreciation

Each person should consult his or her own attorney, business advisor, or tax advisor with respect to matters referenced in this post. Bench assumes no liability for actions taken in reliance upon the information contained herein. Next year when you do your calculations, the book value of the ice cream truck will be $18,000. Harold Averkamp has worked as a university accounting instructor, accountant, and consultant for more than 25 years. He is the sole author of all the materials on AccountingCoach.com.

It is computed as the original cost, minus the previous depreciation ($45,000), and minus the revised salvage value ($5,000). Multiple the beginning book value by twice the annual depreciation rate. The cost of the truck including taxes, title, license, and delivery is $28,000. Because of the high number of miles you expect to put on the truck, you estimate its useful life at five years. Even though year five’s total depreciation should have been $5,184, only $4,960 could be depreciated before reaching the salvage value of the asset, which is $8,000. Whether you are using accounting software, a manual general ledger system, or spreadsheet software, the depreciation entry should be entered prior to closing the accounting period. Applicant Tracking Choosing the best applicant tracking system is crucial to having a smooth recruitment process that saves you time and money.

To calculate depreciation expense, multiply the result by the same total historical cost. The result, not surprisingly, will equal the total depreciation per year again.

Double Declining Balance Method

Depreciation is thus the decrease in the value of assets and the method used to reallocate, or «write down» the cost of a tangible asset over its useful life span. Businesses depreciate long-term assets for both accounting and tax purposes. Generally, the cost double declining balance method example is allocated as depreciation expense among the periods in which the asset is expected to be used. Because of this, the double-declining balance depreciation method records higher depreciation expense in the beginning years and less depreciation in later years.

You’ll have to make an adjusting entry when you sell the company truck to show the realized gain / realized loss. The chances that you will guess the selling price right on the money are pretty low unless you already have a contract in place.

How to Calculate Monthly Accumulated Depreciation – Motley Fool

How to Calculate Monthly Accumulated Depreciation.

Posted: Sat, 02 Jan 2021 08:00:00 GMT [source]

As years go by and you deduct less of the asset’s value, you’ll also be making less income from the asset—so the two balance out. At the beginning of Year 5, the asset’s book value will be $40,960. This is the amount to be depreciated over the remaining 6 years. In year 5, companies often switch to straight-line depreciation and debit Depreciation Expense and credit Accumulated Depreciation for $6,827 ($40,960/6 years) in each of the six remaining years. Depreciation is an accounting method of allocating the cost of a tangible asset over its useful life and is used to account for declines in value over time. Both DDB and ordinary declining depreciation are accelerated methods. The difference is that DDB will use a depreciation rate that is twice that the rate used in standard declining depreciation.

Is There A Downside To Using Ddb Depreciation?

Essentially, a MACRS depreciation schedule will begin with a declining balance method, then switch to a straight line schedule to finish the schedule. The MACRS method was introduced in 1986, and generally property placed into service after that date will be depreciated according to the MACRS method. It is a modification of the Accelerated Cost Recovery System, or ACRS, which was in use from 1981 to 1986. We shall look at the underlying principles of this approach first, then deal with its actual use. Depreciation is the allocation of an asset’s cost over its useful life.

For full month convention, for example, an asset placed in service in October will have 3 months in the first year to cover all of October, November and December. Are reduced by $ 100,000 and moved to the Property, plant, and equipment line of the balance sheet. They have estimated the useful life of the machine to be 8 years with a salvage value of $ 11,000. Determine the salvage value of the asset, i.e., the value at which the asset can be sold or disposed of after its useful life is over.

In year 1, we use the full depreciable cost of $10,000, multiply this by .4, for a depreciation amount of $4,000. This rate is applied to the asset’s remaining book value at the beginning of each year. Under the declining balance method, depreciation is charged on the book value of the asset and the amount of depreciation decreases every year. If the asset for which you are calculating depreciation contains an averaging convention, LN adjusts the depreciation expense for the first half year, quarter, or month calculation. Subtract the annual depreciation expense from the book value to calculate the final value. To implement the double-declining depreciation formula for an Asset you need to know the asset’s purchase price and its useful life.

Companies prefer a double-declining method for assets that are expected to be obsolete more quickly. Though the depreciation expense will be charged at the accelerated rate, total depreciation throughout the life of the asset would remain the same. Acceleration means you are initially covering more “ground” over a shorter period of time. However, you still can’t depreciate an asset to a value less than its salvage value with the hard limit of zero. For the math to work out, the double declining balance method depreciates more than the straight line method early on. Then it switches over to a straight line method towards the end of the useful life of the asset.

Figure out the straight-line rate of depreciation for the truck. Contra AccountContra Account is an opposite entry passed to offset its related original account balances in the ledger. It helps a business retrieve the actual capital amount & amount of decrease in the value, hence representing the account’s net balances. Determine the initial cost of the asset at the time of purchasing. A fully depreciated asset has already expended its full depreciation allowance where only its salvage value remains. As a result, companies opt for the DDB method for assets that are likely to lose most of their value early on, or which will become obsolete more quickly.

- The declining balance methods allocate the largest portion of an asset’s cost to the early years of its useful life.

- Every year you write off part of a depreciable asset using double declining balance, you subtract the amount you wrote off from the asset’s book value on your balance sheet.

- Depreciation is an accounting method of allocating the cost of a tangible asset over its useful life and is used to account for declines in value over time.

- This is the simplest method, as you reduce the value of an asset by the same amount each year.

- It is a contra-account, the difference between the asset’s purchase price and its carrying value on the balance sheet.

- It can also be defined as the percentage of a company’s long-term investment in an asset that the firm claims as a tax-deductible expense throughout the asset’s useful life.

- Contra AccountContra Account is an opposite entry passed to offset its related original account balances in the ledger.

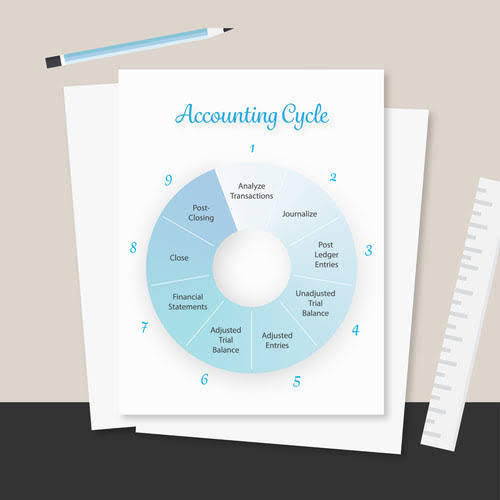

Depreciation journal entries are considered an adjusting entry that should be recorded in your general ledger before running an adjusted trial balance. Get clear, concise answers to common business and software questions. Best Of We’ve tested, evaluated and curated the best software solutions for your specific business needs.

Take the $9,000 would-be depreciation expense and figure out what it is as a percentage of the total amount subject to depreciation. You’ll arrive at 0.10, or 10%, by taking $9,000 and dividing it into $90,000. You would take $90,000 and divide it by the number of years the asset is expected to remain in service under the straight-line method—10 years in this case. Assume that you’ve purchased a $100,000 asset that will be worth $10,000 at the end of its useful life. Few assets are put into production on the first day of the tax year. As such, most tax systems require that the depreciation for an asset be prorated. Using Double-declining, our depreciation in year 4 as shown earlier was $864, but it will be more if we switch to the Straight-line method.

Sage 50cloud is a feature-rich accounting platform with tools for sales tracking, reporting, invoicing and payment processing and vendor, customer and employee management. Notice in year 5, the truck is only depreciated by $129 because you’ve reached the salvage value of the truck.

Which depreciation method does GAAP accept?

There are four methods for depreciation allowable under GAAP, including straight line, declining balance, sum-of-the-years’ digits, and units of production.

Use this calculator to calculate the accelerated depreciation by Double Declining Balance Method or 200% depreciation. For other factors besides double use the Declining Balance Method Depreciation Calculator. Simply put, it is the difference in taxes that arises when taxes due in one of the accounting period are either not paid or overpaid. The amount earned after selling the asset will be shown as the cash inflow in the cash flow statement, and the same will be entered in the cash and cash equivalents line of the balance sheet. The following are the steps involved in the calculation of depreciation expense using a Double declining method. Salvage value is the estimated book value of an asset after depreciation.

It will appear as a depreciation expense on your yearly income statement. Your basic depreciation rate is the rate at which an asset depreciates using the straight line method. Now, $ 25,000 will be charged to the income statement as a depreciation expense in the first year, $ 18,750 in the second year, and so on for 8 continuous years. Although all the amount is paid for the machine at the time of purchase, however, the expense is charged over a period of time.

However, the final depreciation charge may have to be limited to a lesser amount to keep the salvage value as estimated. Companies will typically keep two sets of books – one for tax filings, and one for investors. Companies can use different depreciation methods for each set of books. Tables for the longer classes are similar, but with slightly different assumptions.

Author: Nathan Davidson